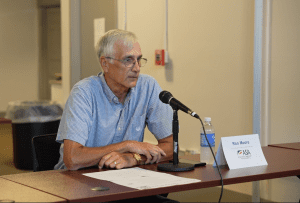

Back in May, rules were released, clarifying the qualifications for the 40B carbon tax credit for 2023 and 2024. This program offers up to a $1.75 per gallon credit for Sustainable Aviation Fuel (SAF) with a carbon intensity (CI) reduction of at least 50 percent when compared to petroleum-based aviation fuel. Grant Strom, Knox County Farmer says that he is disappointed not much more is known for when the 40B tax credit expires.

“We don’t know any more today than we did six months ago. The only thing that came out was the 40B guidelines, which expire at the end of the year, and they’re pretty much meaningless,” says Strom. “Now we’re sitting here on the precipice of basically, you start planting and planning for the ‘25 crop when you harvest the ‘24 crop, and we’re sitting here without any sort of guidance or rules or knowing what’s going to happen for 25.”

As producers wait for more information on the 45Z program, the 40B program acts as a transitional step, giving some guidance into what the program could look like.

Listen to more from the 2024 FS Fall Ag Roundtable on SAF and ethanol markets and trade: