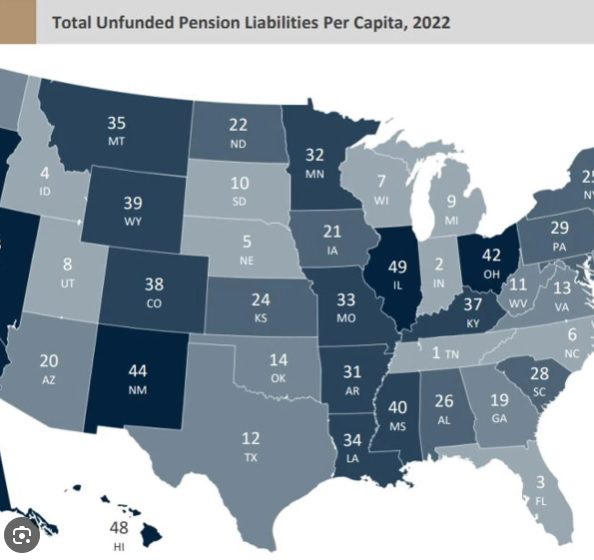

Every man, woman and child in Illinois is on the hook for $37,000 for the state’s unfunded public pension liabilities, according to a new report.

The seventh annual American Legislative Exchange Council’s “Unaccountable and Unaffordable” report on public pension liabilities pegs the amount of debt across the nation at nearly $7 trillion.

Illinois comes in second to last.

“We see the liabilities are truly in a really scary scenario for Illinois for the future, looking at nearly $37,000 in unfunded liabilities for every man, woman and child in the state of Illinois,” said Jonathan Williams, ALEC’s executive vice president of policy and chief economist, explains.

That’s behind only Alaska’s per capita cost of $46,000. In contrast, Tennessee, the state with the lowest per capita cost for public sector pensions is around $7,700. Illinois neighbor Indiana is second with $8,000 per capita.

Illinois also came in second worst for overall unfunded liability and funding ratio.

“So I guess if there’s something to be said, there’s consistency at the bottom of the rankings for Illinois in all of the categories we look at, Illinois is among the worst in the nation,” Williams told The Center Square.

While the Illinois Auditor General puts Illinois’ five state-run public sector pension unfunded obligations at $140 billion, Williams said when considering pensions they’ve reviewed across the state, the total liability approaches half-a-trillion dollars using their criteria.

Some states have done good work in shoring up their costs through a variety of ways.

“The risk is shared not just among taxpayers but workers as well who need to increase their own contributions to the plan in their investments fall short of their goal,” Williams said. “So, we’ve seen some really innovative ways that states have begun to tackle liabilities.”

States with large unfunded liabilities left unresolved will have difficult decisions to make, Williams said.

“This is an issue that is going to cause, I think, widespread tax increases, widespread cuts to government services or a mixture of the two,” he said.

Illinois spends $1 out of every $5 it collects in taxes for pensions.

Williams also warned of “politically motivated investment schemes” he said “are also a growing threat to the solvency of state pension funds.”

“These strategies reduce investment returns over the long term, which leads to underfunding in state pension plans across the country with taxpayers ultimately footing the bill for the shortfalls,” he said.

***Courtesy of the Illinois Radio Network***